We have created this page to help graduates who are interested in a career as an actuary.

Perhaps you have just finished, or you are in the process of finishing an actuarial science degree. Or maybe you have undertaken a mathematics, economics or statistic degree and the idea of helping to “make financial sense of the future” and manage the financial risk of companies appeals.

This page contains lots of useful resources to get you started on your actuarial journey.

What is an Actuary?

Contrary to popular belief, actuaries don’t work with birds, shoot arrows or act!

Actuaries use their mathematical skills and analysis of past events to help measure the probability and risk of future events. Actuaries are problem solvers and strategic thinkers with a deep understanding of risk and the financial world.

Actuaries work in a range of different practice areas and the range of areas actuaries work in is growing all the time as the profession expands into wider fields. The main areas actuaries work in:

More information on these is provided on each of these areas below:

Different actuarial practice areas:

Becoming an Actuary?

A career in actuary has consistently been ranked as one of the best in the world.

Even if you have studied an actuarial degree you will still have some exams to complete once you begin work.

On qualification as an actuary the learning doesn’t stop and you will be expected to keep up to date with current actuarial developments and your responsibility within the company will increase.

Common Graduate Questions

The most commonly asked questions by graduates are listed below:

When to apply?

You should start applying directly for graduate positions either in response to the university visits/adverts from hiring companies or otherwise from October through to May of your graduation year.

How to prepare a CV?

Acumen Resources provide full CV Preparation guidelines for registered candidates (Extract Below)

Your CV is a marketing document and should be carefully designed with the aim of helping you get an interview. It should be tailored to your unique skills and experiences.

You CV should include the following:

In general your CV should show:

How do I prepare for an interview?

Acumen Resources provide full Interview Preparation guidelines for registered candidates attending interviews (Extract Below). We also provide a mock interview service taking candidates through commonly asked questions.

Acumen Resources suggest the following format for your Interview Preparation:

- Gather information on company and the role

- Prepare your key message

- Identify key questions

- Prepare answers

- Prepare your own questions for the interviewers

- Practise ALOUD

What to look for in a prospective employer?

We recommend you chose an employer where you will work closely with a qualified actuary. You should ask about the ratio of students to qualified actuaries and the size of actuarial team in general. Other students will provide a support network for you over the exam session and will give you useful advice on using study leave and study techniques. Most companies provide a comprehensive study package which will cover all your study materials and time off work to prepare for the exams.

Direct writer vs. consultancy?

Whether you would prefer to work in a consultancy or a direct writer is very much a personal decision. The main difference between consultancy work and working for a direct writer is the variety of work involved. By working in a consultancy you will get involved in different projects with many different clients. If you work in a direct writer you will usually work in a team on one actuarial function e.g. pricing or financial reporting. There will usually be little overlap between the 2 functions. However many employers operate a rotation scheme where approximately every year you will get rotated around different actuarial teams – this is important to ensure you gain a wide range of skills on the road to qualification.

Which Practice area?

Many graduates take the first job offered to them after college but there is a big difference between roles across the different practice areas. Below are sample graduate job specifications for the main practice areas:

Exam Information

UK & Ireland

There are three main parts to an actuarial qualification:

1) Exams

2) Professionalism

3) Work-based experience

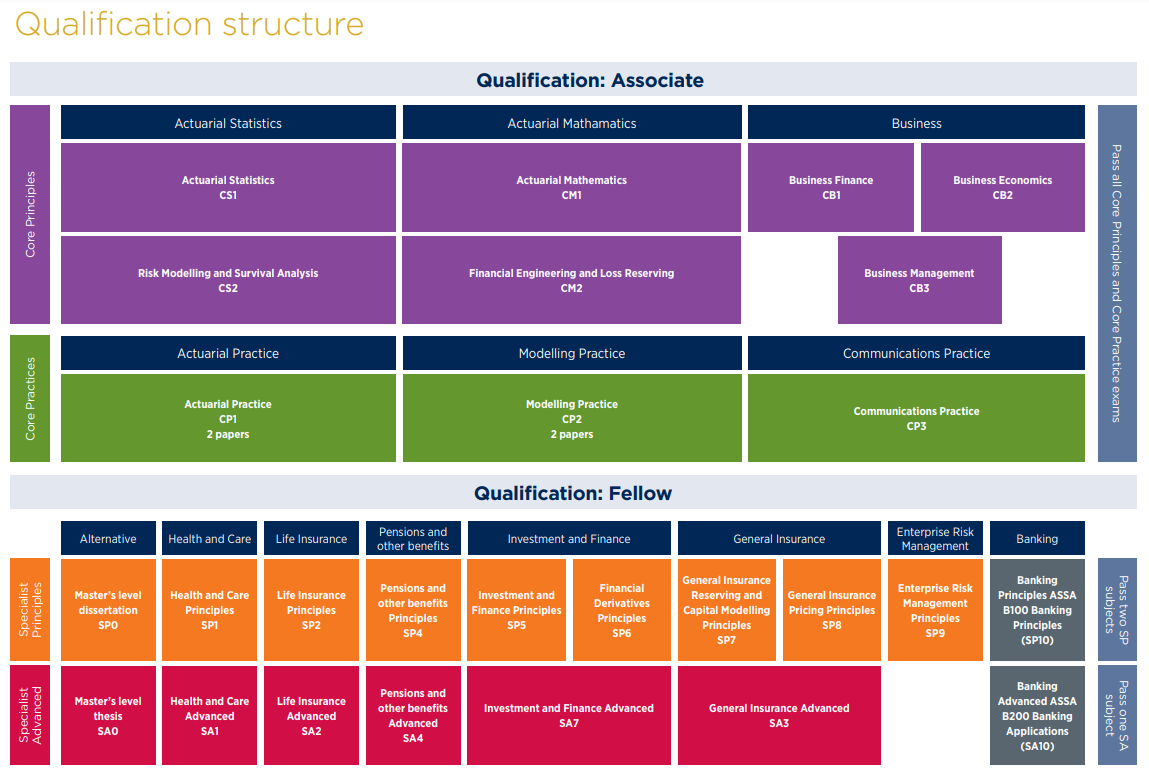

The Institute and faculty of Actuaries (IFoA) have put in place a new curriculum since 2019. There are now four stages to qualifying as an actuary. The first two stages are required to become an Associate and all four stages are required to become a fully qualified Fellow.

Core Principles

The Core Principle exams replace the Core Technical (CT) exams in the old curriculum. There are three main modules: Actuarial Statistics, Actuarial Mathematics & Core Business. You may get exempt from all or most of these exams from an IFoA accredited university degree.

Core Practices

There are three core practice subjects and you must pass all of them. They are Actuarial Practice (CP1), Modelling Practice (CP2) and Communications Practice (CP3).

Specialist Principles

There are currently 10 specialist principle exams and you must pass two of them enroute to becoming a qualified Fellow.

Specialist Advanced

You need to pass one of the seven SA subjects available. No exemptions are available.

Below is a helpful graphic form the IFoA highlighting visually what the road to Associateship and Fellowship qualification looks like:

Source: Institute and Faculty of Actuaries

Exams can be sat in April or late September/early October. The study session from May to September is shorter and so it may be difficult for you to study at the same rate during this time. In order to qualify as a fellow of the institute of actuaries you will need to complete all the above exams and 3 years work experience which must be documented.

Full details of the IFoA exam curriculum can be found here.

Links

Professional Bodies

Postgraduate Degrees and Diplomas

A number of postgraduate degrees and diplomas are available where exemptions can be gained for the early and later actuarial exams.

Ireland

Other Useful Links

ProActuary

BeAnActuary

Actuview